Invest in Wine & Spirits with a Cru Managed Portfolio

Our specialists find you the best buying and selling opportunities, giving you excellent financial returns.

- We invest in wine for you, generating significant gains

- Our proven track record is exceptional

- Low management fees & FREE wine storage

- You own your portfolio at all times. This is not a wine fund

With a proven track record our trusted advisors will help you invest in wine safely & securely.

Our Managed Portfolio advisors will look to understand your requirements and help you every step of the way.

Once our specialists have selected the wine for your portfolio you will receive quarterly reports.

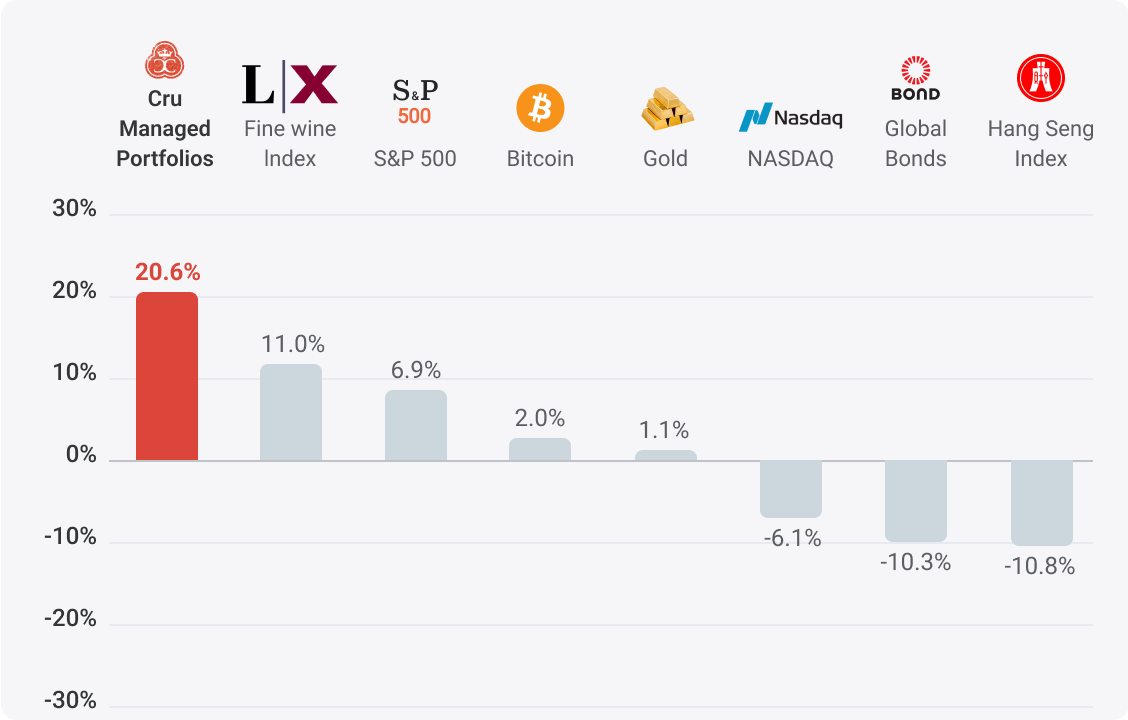

Investing in wine as an alternative asset has a proven track record that has outperformed other mainstream markets.

- We source, purchase, and manage a portfolio of wine / spirits on your behalf

- You become a ‘wine trade insider’, buying & selling at cost (not retail) prices

- You are the sole owner of all the products in your portfolio & they are stored in your account

- By buying & selling fine wine we can make you significant financial returns on invested capital

- It is a great way to hedge against inflation - and benefit from a highly inefficient market

- We serve wine investors and collectors globally and have dedicated teams in the UK, EU, Hong Kong and Singapore

- Our global reach allows us to source and sell fine wines at exceptional prices

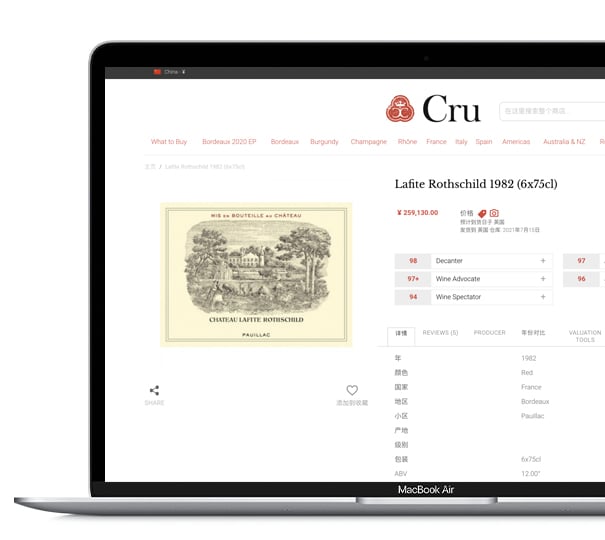

- View your Managed Portfolio online and receive regular performance updates

- Storage is completely FREE and our management fees are tiered so the more you invest the less you pay

- Our proven track record speaks for itself and existing clients are already witnessing huge gains

Our Partners

Pay less the more you invest

You can start a Managed Portfolio from as little as $US50,000 and a minimum term of three years. The more you invest the lower your management fees will be.

(minimum investment)

- 3 years minimum hold

- Quarterly reports

- Complete ownership of wines stored in your Cru Storage Account

- View performance online - coming soon

- Zero buying and selling fees

- FREE Storage

- 3% management fee

(minimum investment)

- 3 years minimum hold

- Quarterly reports

- Complete ownership of wines stored in your Cru Storage Account

- View performance online - coming soon

- Zero buying and selling fees

- FREE Storage

- 2.5% management fee

(minimum investment)

- 3 years minimum hold

- Quarterly reports

- Complete ownership of wines stored in your Cru Storage Account

- View performance online - coming soon

- Zero buying and selling fees

- FREE Storage

- 2% management fee

- A fixed supply asset like wine equals a great inflation hedge

- Spreads in fine wine trading are wide, signalling significant arbitrage possibilities

- The Fine Wine Indices on Liv-Ex regularly out-perform major international markets

- Our propriety analysis tools flag undervalued trading opportunities

- You will always have legal ownership of the assets in the portfolio which is also fully insured at replacement value

- Contact us for more information and speak with one of our advisors. They will talk you through the whole process and answer any questions

- Minimum investment is $US50,000 and minimum hold is 3 years. Fees are the same as a typical hedge fund

- Your Managed Portfolio manager will start sourcing and selling wines to grow your portfolio immediately

- View your portfolio online and check the performance 24 hours a day. You will also receive regular email updates

- Managed Portfolios are overseen by former Goldman Sachs / Deutsche Bank Managing Director