Notifications

Sign In / Create Account

×To view your Cru account or access our tools or features, please sign in or create a new account

重要提示

通过本网站购买的葡萄酒或烈酒暂时未能交付到中国。我们正在积极地与我们的物流合作伙伴制定以解决方案,以至能够尽快把您的葡萄酒配送到您的手上。

目前,您可以继续在香港、新加坡、波尔多或伦敦的专业仓储设施之一购买、存储或转移您的葡萄酒。或者,您可以安排从香港收集您的葡萄酒,并由您自己的物流供应商运送到中国。

- Selections

- France

- Spain

- Australasia

- South Africa

- Italy

- Americas

- Rest of the World

- Spirits & Fortifieds

- Actively Trading

- All Markets

- Top Markets

- Tightest Spreads

- New Bids

- New Offers

- Biggest Movers

- About Cru Markets

- Summary

- My Portfolio

- List for Sale

- Analysis

- Performance

- External Transfers

- Breakdown

- Condition Verification Check

- Portfolio Management

- Fine Wine Market Research

- Whisky Market Research

- Compare Vintages

- Relative Value Analyser

- Request a Demo (private clients)

- Request a Demo (trade clients)

- AI Wine Expert

- Cru Wine App

- Arrange a Delivery

- Delivery Costs

- Invite Friends

- Storage

- Producer Partnerships

Cru is one of the world’s leading fine wine retailers. We have experts working across the globe serving customers in over 40 different countries. We operate from four major hubs in London, Hong Kong, Bordeaux, Singapore, Beijing and San Francisco, from which we offer advice and impeccable service through both traditional and digital channels. We are very focused on using technology to make the experience of fine wine buying more fun and convenient.

Cru is a specialist retailer. We source only the world’s very best wines and spirits and sell to a limited number of discerning buyers. We hold numerous events through which we showcase our wines and get to know our clients even better. We store a significant amount of wine for our clients and offer guidance on wine portfolio construction.

Cru offers an internationally acclaimed selection of red wine, white wine and Champagne. We help customers around the world buy wine from Bordeaux, Burgundy, Italy, Spain, the Loire and Rhone Valley and from the New World.

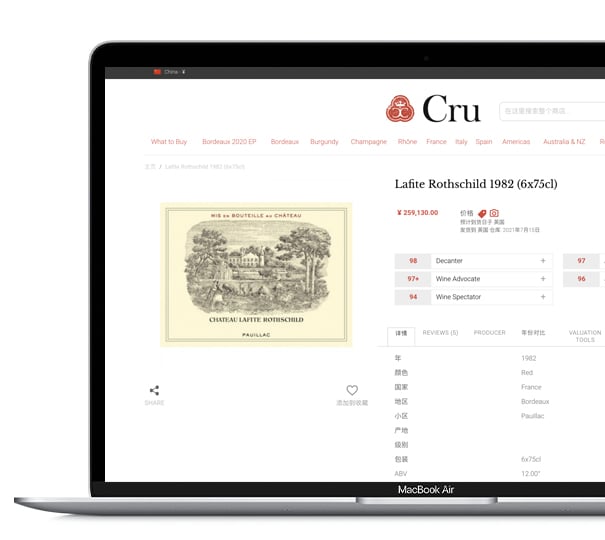

We stock extensive collections of the world’s finest wines, including Château Lafite, Château Latour, Château Margaux, Château Mouton Rothschild, Château Haut Brion, DRC and Penfolds.

Cru was founded in 2014 by co-founders Simon Farr and Jeremy Howard. But our roots as a fine wine team go back to the early 1980s in the UK, and back to 2010 in Hong Kong.

Mr Simon Farr: a hugely respected 40 year wine industry veteran who was involved in the founding and growth of two of Britain's most successful wine enterprises (Majestic and Bibendum). Jeremy Howard is a former investment banker who has been building ecommerce businesses in fine wine since 2008.

London

SW1W 0BD

UNITED KINGDOM

+44 (0) 207 235 2100

23 Luard Road

Wan Chai

HONG KONG

+852 3590 4472

6A Shenton Way

Singapore 068815

SINGAPORE

+65 6914 9809

San Francisco

CA 94105

UNITED STATES

Boulevard Plaza Tower 2

Downtown Dubai

U.A.E

- About Us

- contact

- wine storage

- sell your wine

- delivery

- terms & conditions

- privacy & cookies

- payments

- careers

- Sustainability

- Alipay

请先登录

产品:

所需数量:

At a Maximum Price of:

(Estimated Price Range - )

点击确认即表示您同意,我们可以在您的价格范围内提供葡萄酒。

您可以随时修改或取消您的预购或分配请求。