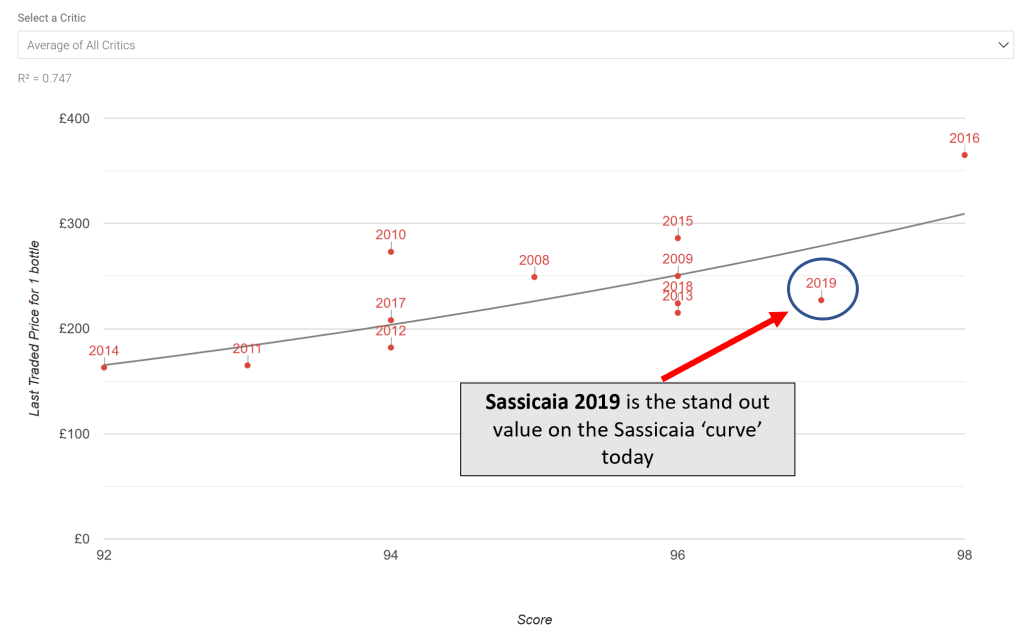

- Sassicaia 2019 is the most attractive Sassicaia vintage right now, in terms of score and price.

- The 2019 is the third best in Sassicaia history, with 98 points from Wine Advocate, bettered only by the 1985 and 2016.

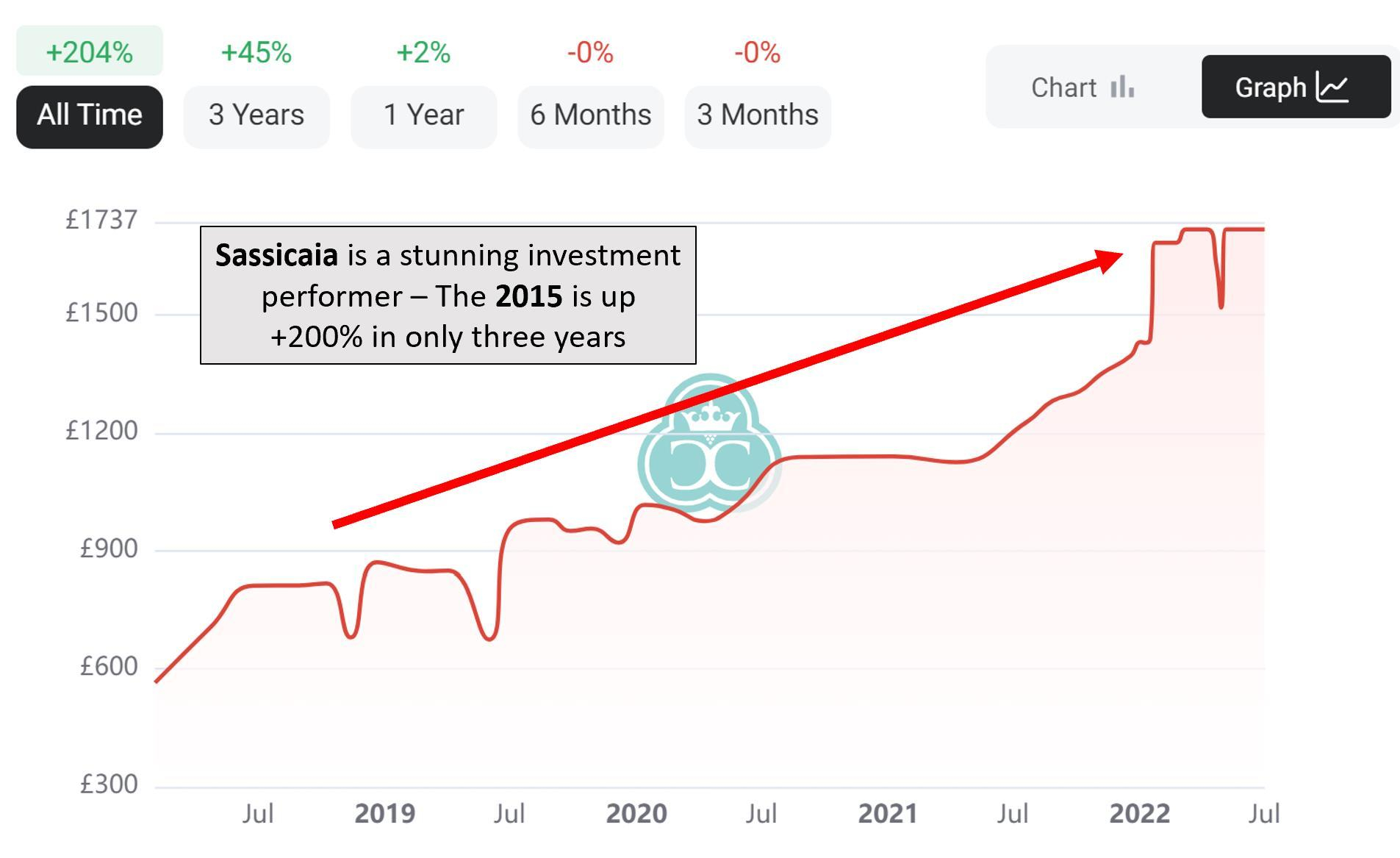

- Sassicaia has been a phenomenal investment performer as demand for top Super Tuscans has ignited across the world. We see no signs of this demand abating.

- The 2019 Sassicaia is a ‘must own’ vintage (along with the 2016) in all serious portfolios. Collectors need to grab it now whilst it is still available at a ‘primary market’ price.

Sassicaia 2019: The Most Attractive Sassicaia Today

Sassicaia 2019 has the most attractive combination of score and price today. Scoring 98 points from Wine Advocate, and priced at only USD 1,750 per (6x75cl), it is significantly undervalued versus other vintages:

Sassicaia 2019 is the third best ever vintage (since production started in 1968), and its current price compares very favourably with the only two vintages to outscore it (1985 and 2016):

Sassicaia: A Proven Investment Performer

Sassicaia has earned a reputation amongst collectors as one of the most reliable investment performers of the past decade. The global obsession with Super Tuscans shows no sign of abating, and Sassicaia is now the undisputed ‘king’ of this category (Masseto being made in too small a quantity to be a widely owned name). The performance of the Sassicaia 2015 is a good indicator of how demand has exploded for this producer. The 2015, despite scoring ‘only’ 97 points from Wine Advocate, has risen over +200% in less than three years:

Sassicaia 2019: Third Best Vintage since 1968

Sassicaia 2019: Third Best Vintage since 1968

The 2019 vintage of Sassicaia is, according to Wine Advocate, the third best vintage ever (production began in 1968). It scores a superb 98 points from Monica Larner. As an aside, a handful of bottles of Sassicaia 1968 are available on the secondary market, with decent quality bottles now worth around US$2,000 per bottle. Monica Larner tasted a bottle of the 1968 in 2017 and scored it 96+ points, noting “a level of energy and verve that absolutely defies its age.” She said it would drink until 2026 at least! This bodes very well for modern iterations like 2015, 2016 and 2019, which clearly have a spectualar 50 year life ahead of them.

Returning to the Sassicaia 2019, of this Larner writes:

“The 2019 is one of the prettiest and most balanced editions of Sassicaia we've seen this past decade, along with the back-to-back duo of 2016 and 2015. The 2019 marries the precision of the 2016 with the rich fruit weight of the 2015 … 2019 is one of the great vintages in the modern history of Bolgheri Sassicaia. It is elegant and forthcoming now (although the wine must be given ample time to open), and it promises to withstand the test of time. The 2019 Bolgheri Sassicaia is a wine to collect and keep.”

The Sassicaia 2019 will continue to improve, according to Larner, until least 2055.

This wine is an absolute ‘must own’ for every serious collector (along with the 2016, of course!).

All Sassicaia Vintages (since 1968) – Ranked by Wine Advocate Score

IMPORTANT NOTICE

This report has been issued or approved for issue by an entity forming part of Cru (as defined below) and has been forwarded to you solely for your information and should not be considered as an offer or solicitation of an offer to sell, buy, or subscribe to any securities or any derivative instrument or any other rights pertaining thereto (“financial instruments"). This report is intended for use by professional or business investors only. This report may not be reproduced without the consent of Cru.

The information and opinions expressed in this report have been compiled from sources believed to be reliable, but, neither Cru, nor any of its directors, officers, or employees accepts liability from any loss arising from the use hereof or makes any representations as to its accuracy and completeness. Any opinions, forecasts or estimates herein constitute a judgement as at the date of this report. There can be no assurance that future results or events will be consistent with any such opinions, forecasts, or estimates. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied is made regarding future performance. This information is subject to change without notice, its accuracy is not guaranteed, it may be incomplete or condensed and it may not contain all material information concerning the product or products mentioned. Cru is not agreeing to, nor is it required to update the opinions, forecasts or estimates contained herein.

The value of any products mentioned in this report can fall as well as rise. Foreign currency denominated products are subject to fluctuations in exchange rates that may have a positive or adverse effect on the value, price or income of such products.

This report does not have regard to the specific instrument objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any products or investment strategies discussed in this report.

Cru (or its directors, officers or employees) may, to the extent permitted by law, own or have a position in the products of any company or related company or products referred to herein and may add to or dispose of any such position or may make a market or act as a principal in any transaction in such products. Directors of Cru may also be directors of any of the companies mentioned in this report. Cru (or its directors, officers or employees) may, to the extent permitted by law, act upon or use the information or opinions presented herein, or research or analysis on which they are based prior to the material being published. Cru may have issued other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect the different assumptions, views and analytical methods of the analysts who prepared them.

For the purposes of this disclaimer, “Cru” shall mean: (i) Cru London Limited; (ii) Cru Asia Limited and (iii) from time to time, in relation to Cru London Limited and/or Cru Asia Limited, the ultimate holding company of that entity, a subsidiary (or a subsidiary of a subsidiary) of that entity, a holding company of that entity or any other subsidiary of that holding company, and any affiliated entity of any such entities.

This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or disclosed to another party, without the prior written consent of an entity within Cru. Products referred to in this research report may not be eligible for sale in those jurisdictions where an entity within Cru is not authorised or permitted by local law to do so. In particular, Cru does not allow the redistribution of this report to non-professional investors or persons outside the jurisdictions referred to above and Cru cannot be held responsible in any way for third parties who effect such redistribution or recipients thereof. © 2022.